About us

Automated compliance checks for the regulated sector

Veriphy has been serving the regulated sector since 2007 and is part of Davies. The services we provide are designed primarily for regulated and parallel entities who are legally required to maintain AML and regulatory compliance, with the added bonuses of:

- Increasing client onboarding speed

- Optimising customer experience

- Minimising time-to-revenue

- Mitigating and controlling risk within a secure data environment

Our aim has always been, and always will be, to aggregate best-of-breed data, and make it available with maximum flexibility, to marry regulatory compliance with commercial need.

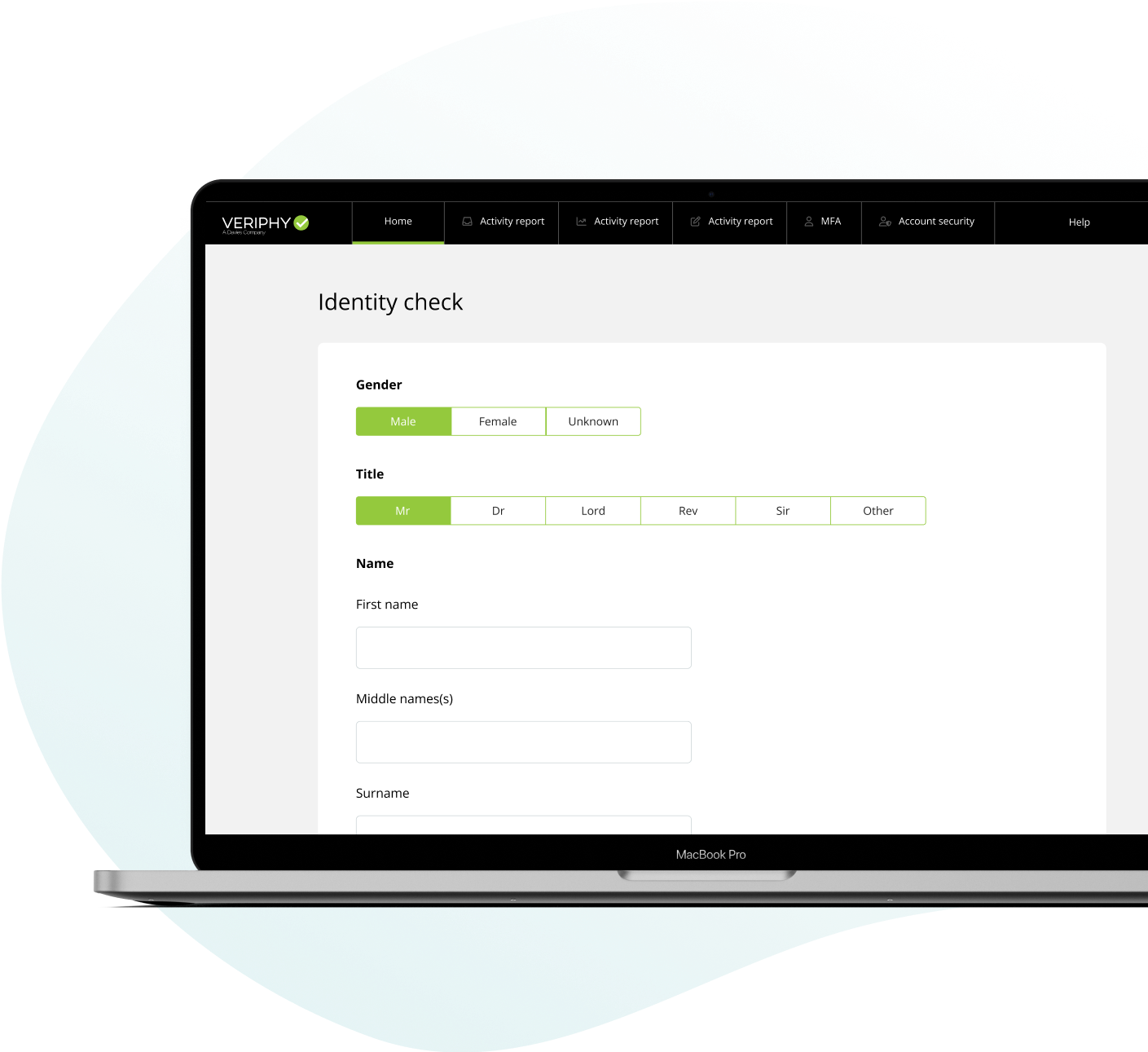

Our online AML, KYC, KYB, PES, personal identity and entity verification checks align with AML and POCA regulations and JMLSG guidelines, while providing flexible and user-friendly customer experience.

Automated compliance checks by Veriphy.

What we do

Our services enable clients from legal, accounting, financial, banking, property, conveyancing, insurance and other regulated sectors to:

- Orchestrate, automate, and optimise perpetual compliance and onboarding processes

- Boost customer experience

- Accelerate revenue

- Avoid regulatory penalty

- Minimise risk and exposure to fraud

The pain points we help solve

All businesses will have their own hang-ups, but for regulated entities, there are a couple of common problems they typically face—and that we can help you to solve. These include:

- The requirement to comply fully with AML legislation to avoid financial loss and reputational damage

- The requirement to onboard new clients efficiently and to create optimal customer experience and robust security, enabling rapid access to solid customer revenue streams

- The increasing risk from fraudulent bad actors and the consequential financial and reputational damage

About our verification platform

Veriphy’s ISO27001-certified secure verification platform offers a unique combination of checks from multiple digital sources via a web UI or a single highly-malleable API hub. This offers both full compliance and operational best-fit with workflow, packaged within a service delivery model that’s based on flexibility, security, rapid support, and excellent customer service.