Do you struggle with…?

- Onboarding entities and individuals with minimum fuss

- Understanding ownership structures and risk levels

- Maintaining compliant customer and supplier due diligence

- Finding time to manage ongoing relationships

If so, you’re not alone. While every business has its own challenges, as growth happens, there are some common pain points regulated companies run into when trying to encourage further growth—especially when it comes to meeting compliance requirements.

With Veriphy Enterprise, you can manage multiple aspects of compliance simultaneously from one platform, while creating a superior onboarding experience for all your clients. And with continuous monitoring, you can trust that your business will always be on the right side of the regulator.

What can Veriphy Enterprise do?

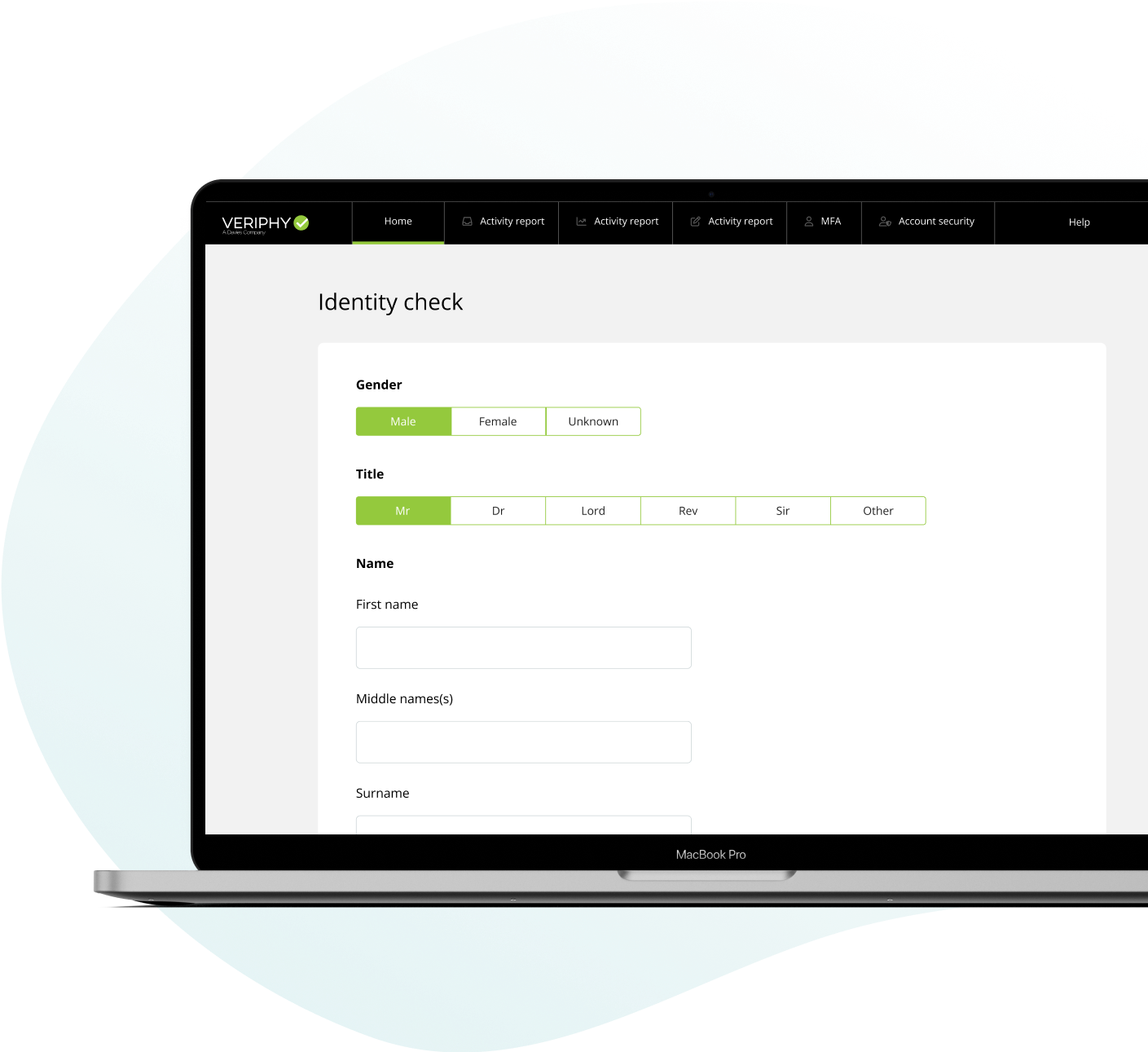

Veriphy Enterprise is a multi-purpose entity onboarding and ongoing compliance platform, and our first ever subscription-based product, which can help your company:

- Onboard, upload, verify, store, and manage multiple clients and suppliers

- Conduct rapid PEP and sanctions screens on beneficial owners, directors and PSCs

- Provide instant AML checks to ensure client due diligence for regulated firms, including the insurance and financial services sectors, legal, property, and more

- Reduce risk through ongoing bespoke customer and supplier management and reporting

- View ownership structures and determine UBOs

- Protect you from regulatory penalty, fraud, commercial risk, human error, and the stress of simply not having enough time

Gold standard data partners

The benefits of Veriphy Enterprise

- Onboard businesses and individuals rapidly with minimum fuss

- Understand ownership structures and assess risk levels

- Maintain compliant customer and supplier due diligence automatically and perpetually

- Manage auditable & transparent ongoing entity relationships from a single platform

- Protect your business from risk, reputational damage and regulatory non-compliance

- Reduce operational costs

- Configure business intelligence visibility

- Empower employees and augment productivity

The Veriphy promise

Our range of AML compliance solutions have been developed with businesses like yours in mind. With our expert AML technology, you can shield your business from bad actors, and prevent criminal exploitation and regulatory fines further down the line.

Our automated compliance tools are purpose-built to help you maintain compliance, increase efficiency of onboarding, and manage and mitigate risk.