Our KYC verification tools can help mitigate risk and optimise your client’s onboarding experience.

Over £1.2bn was stolen by criminals through authorised and unauthorised fraud in 2022, equivalent to over £2,300 every minute.

KYC compliance is critical to protect your business from dealing with people who have illegitimate intentions. And so, is an important part of the customer risk assessment.

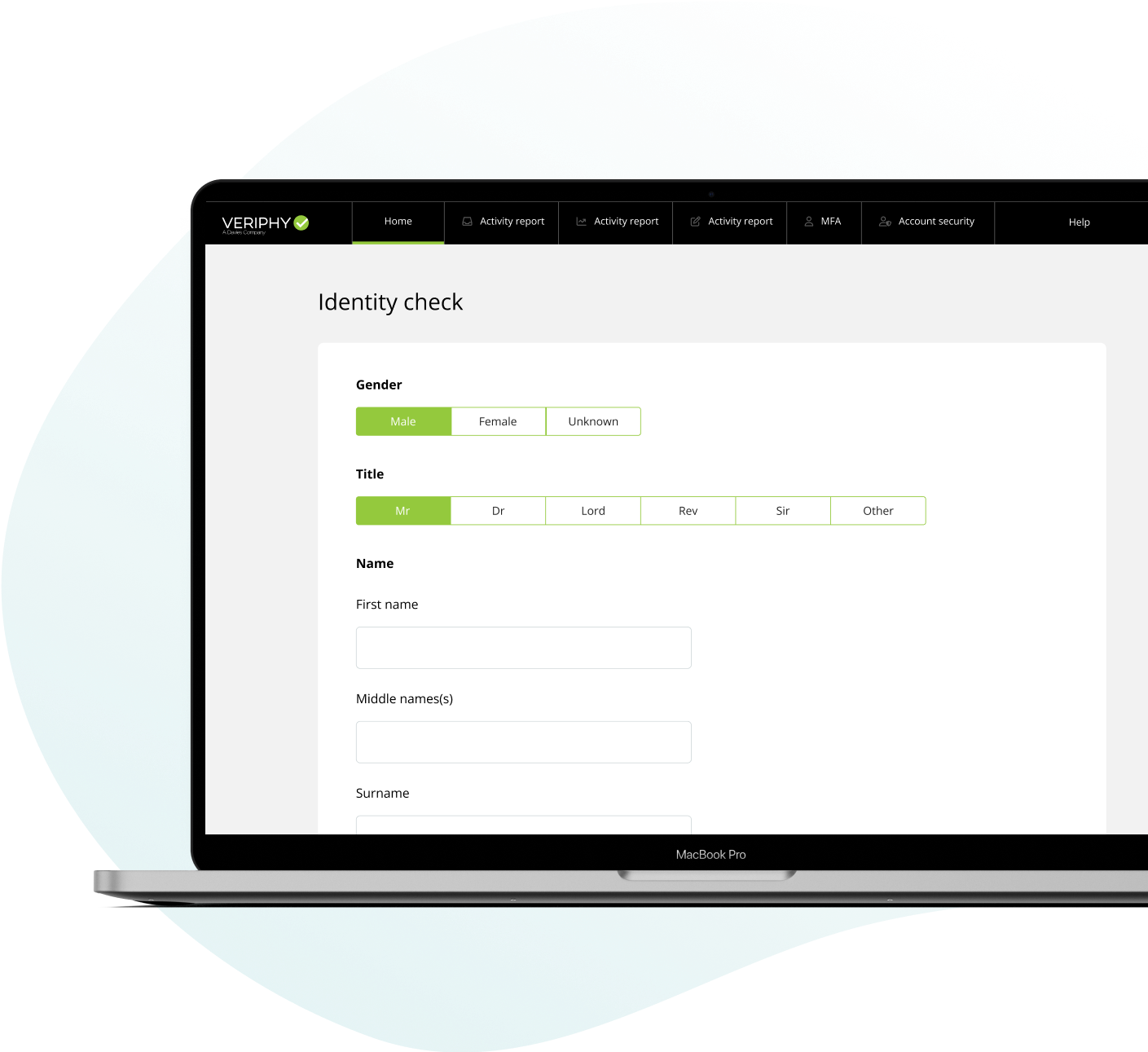

Our KYC compliance technology is designed to defend your business from identity fraud, and simplify your customer onboarding process with electronic verification that removes the risk of human error.

Our KYC compliance suite can help you to:

- Mitigate against fraud: Gives you the power to strengthen your customer risk management process, and help to improve your overall customer experience.

- Expedite and upgrade the customer experience: Enables you to efficiently and effectively verify client information for quicker and more efficient onboarding.

Verify client identity quicker

Our KYC suite has what you need to verify and validate client information and protect your business against identity fraud, including:

ID Checks

Our KYC products offer you access to authoritative data sources to reassure you of who you’re working with.

Our ID Checks cover:

- ID validation

- Client identity and address validation

- Global ID validation

- UK address validation

- Bank account validation

Electronic Identity Verification (EIDV)

This advanced KYC solution enables you to carry out seamless and efficient onboarding, allowing you to verify customer information on-the-go.

You can benefit from:

- Biometric liveness checks

- Facial recognition technology

- Document capture and authentication

Manage risk and ensure compliance with our adaptable API

An effective KYC compliance regime can help your business to manage risk, comply to regulations, and improve the customer experience. With our flexible and adaptable API, you can choose a solution that works for your individual clients and best fits your business needs, giving you the best of both worlds. Our consultants are also qualified to advise on how to make the most of your first impressions, using their expertise and our KYC to optimise the customer experience.