Accountants are seen as gatekeepers of the financial services sector, so it’s critical that you’re acting with integrity and to prevent financial crime from occurring. This means taking the time to thoroughly verify client identity before dealing with any money matters for them.

There are many risk areas for accountants with regards to money laundering, and as such, robust policies and processes are recommended by regulators. With our suite of AML checks for accountants, you can rest assured that your business is being thoroughly screened against up-to-date, market-leading databases to verify client identity and suitability.

Our AML checks for accountants

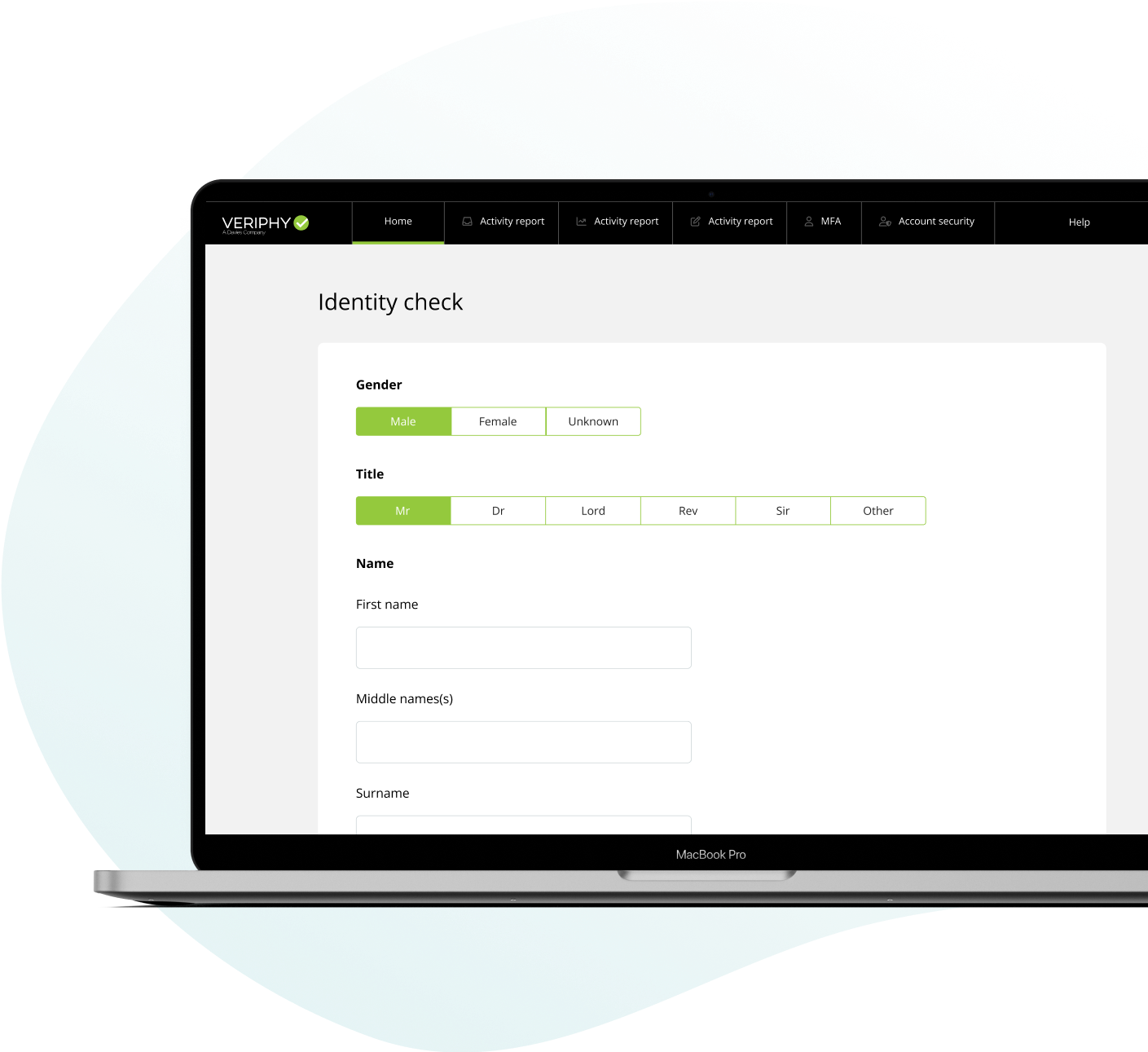

Our AML solutions suite for accountants allow you to verify the identity of applicants, and screen them against global PEP and sanctions lists in seconds.

Quickly assess and validate client identity and address using our identity checks. Our JMLSG and 5th Directive compliant AML checks will verify your clients against:

- Full and edited UK electoral registers (current and historical)

- Recent credit file activity data

- Birth index register

- Telephone directory

- Mortality register

- Departure register

- Sanctions (HMT, EU and OFAC)

- Global and UK domestic global PEP and sanctions lists

We also offer optional screening services for UK and global passports, GB driving licenses, and National Insurance numbers, as and when you need them.

The benefits of our AML checks for accountants

When you use our product suite designed for accountants, you will access a host of benefits. These include:

- Instant processing time: Our money laundering checks validate client identity in approximately 2 seconds, so you can get down to business quicker.

- Streamlined client onboarding: With super quick verification time, you can guarantee a smoother, more efficient client onboarding journey.

- Flexible and cost-effective compliance: Our flexible compliance model enables you to keep your use in line with your designated risk management expenditure. With no contract, you will only pay for the checks you’ve used.

- Continuous monitoring: Maintaining compliance past the point of onboarding is crucial. That’s why our PEP and sanctions alerts system has options to periodically screen your clients, either on a weekly or monthly basis.

Optimise your compliance strategy with batch processing

Compliance goes far beyond screening at the point of onboarding. That’s why we designed our AML checks with a batch processing function, so you can assess your legacy clients in one go.

It’s an efficient and effective way to process numerous quantities of AML and PEP/sanctions checks. Once our technology has run the checks, you will receive collated and individual reports for each client. These come with an instant overview and custom filter options, ensuring you get the most from your compliance process.

Streamline client onboarding with API integration

Our AML checks for accountants ensure you stay within the recommended guidance from the regulators, while making for a more efficient and effective client onboarding journey.

With the help of our expert consultants, you can seamlessly integrate our AML checks into your existing systems, enabling you to conduct all your compliance checks from one place.