As a bookkeeper, you no doubt already understand the implications of not validating identity and financial records, with large penalties on the line for businesses and individuals who fail to complete appropriate AML processes.

Here at Veriphy, we aim to make compliance easy for you. With several solution suites of world-class AML and KYC technology, we can help to put your mind at ease and offer your organisation greater protection.

Our compliance suite for bookkeepers

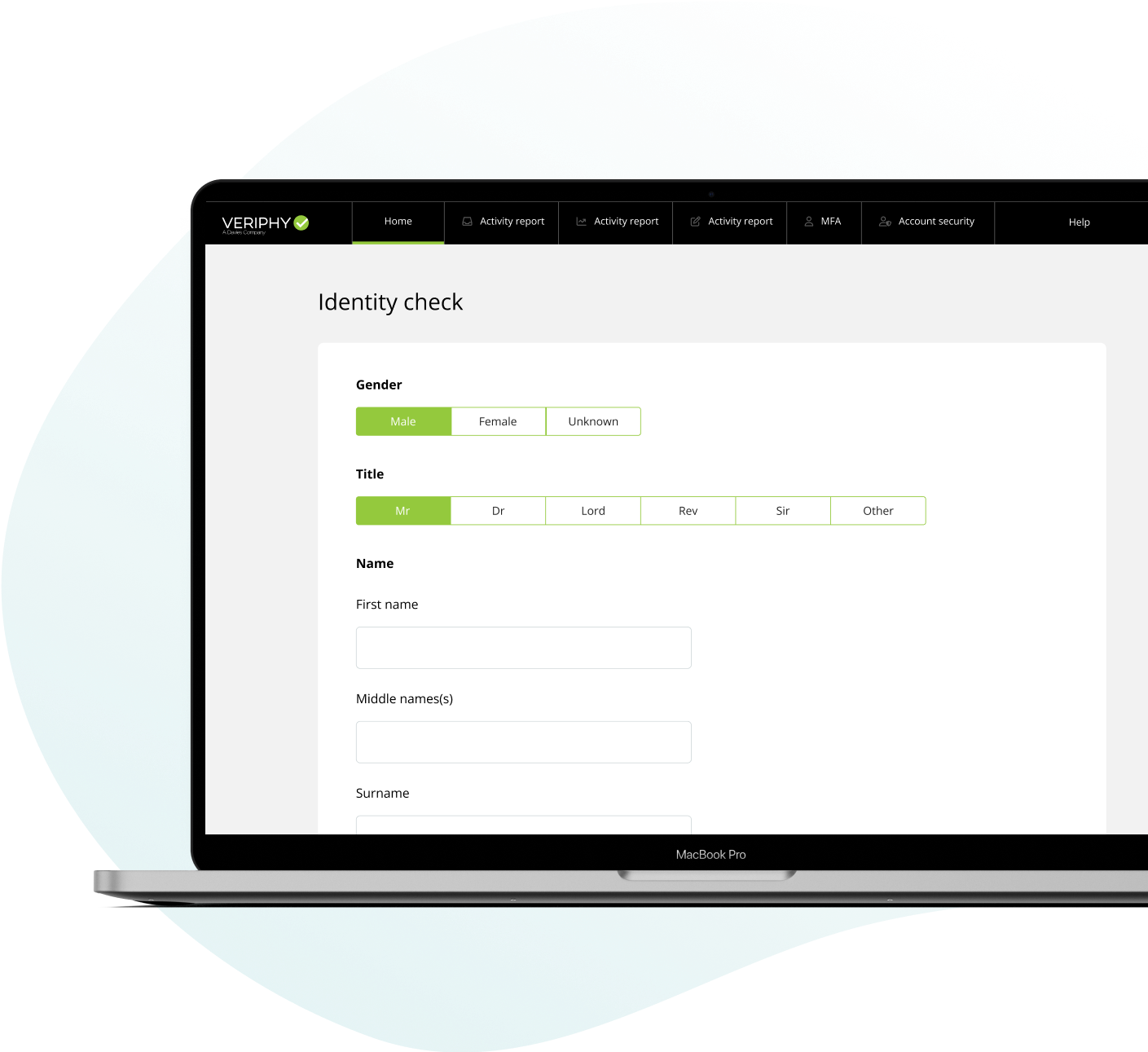

Our compliance suite can help you to stay on the correct side of the law through validation of your clients’ identity, financials, and personal details, as well as creating a smoother client onboarding process.

Meet compliance standards with our company reports

Our company report checks are designed to give you an overview of the financial stability of UK and international businesses, before you take them on as a client. Our reports collect large volumes of insightful data, including:

- The business’s financial stability

- The business’s credit rating/score

- Identification of any UBOs within the business

- Any adverse information e.g., CCJs, bankruptcies

Maintain compliance with our AML solutions suite

Our AML solutions suite has been designed to offer you ultimate protection against money laundering and other types of financial crime, helping you to avoid financial and reputational damage.

Our AML checks can be used to validate and verify:

- Global ID and ID documents

- UK addresses

- Bank accounts

- Biometric liveness

Our PEP and Sanctions checks protect your business from high-risk clients and provide continuous monitoring on clients who may carry out financial crime in the future. Our Source of Funds checks validate the legitimacy of client funds, preventing the risk of money laundering.

We even have batch checks available to assist with book acquisition and annual client base screenings, for a more time- and cost-efficient way to get things done.

The benefits of our compliance solutions for bookkeepers

Our solutions suites enable you to:

- Orchestrate and optimise your compliance and onboarding processes

- Enhance your customer experience

- Maximise your revenue potential

- Avoid regulatory penalties

- Minimise risk and exposure to fraud