Compliance solutions for high-value dealers

Safeguard your dealership from financial crime.

Our compliance solutions for high-value dealers

As a sole trader or business accepting, or sending, high-value cash payments, you have a responsibility to prevent money laundering and other types of financial crimes arising from, or during these transactions. We have curated compliance suites to help you avoid financial and reputational damages. We have the tools you need as a high-value dealer for sustainable growth, continuous and perpetual AML and KYC, and to prevent risk and compliance failures.

Maintain compliance with our AML solutions suite

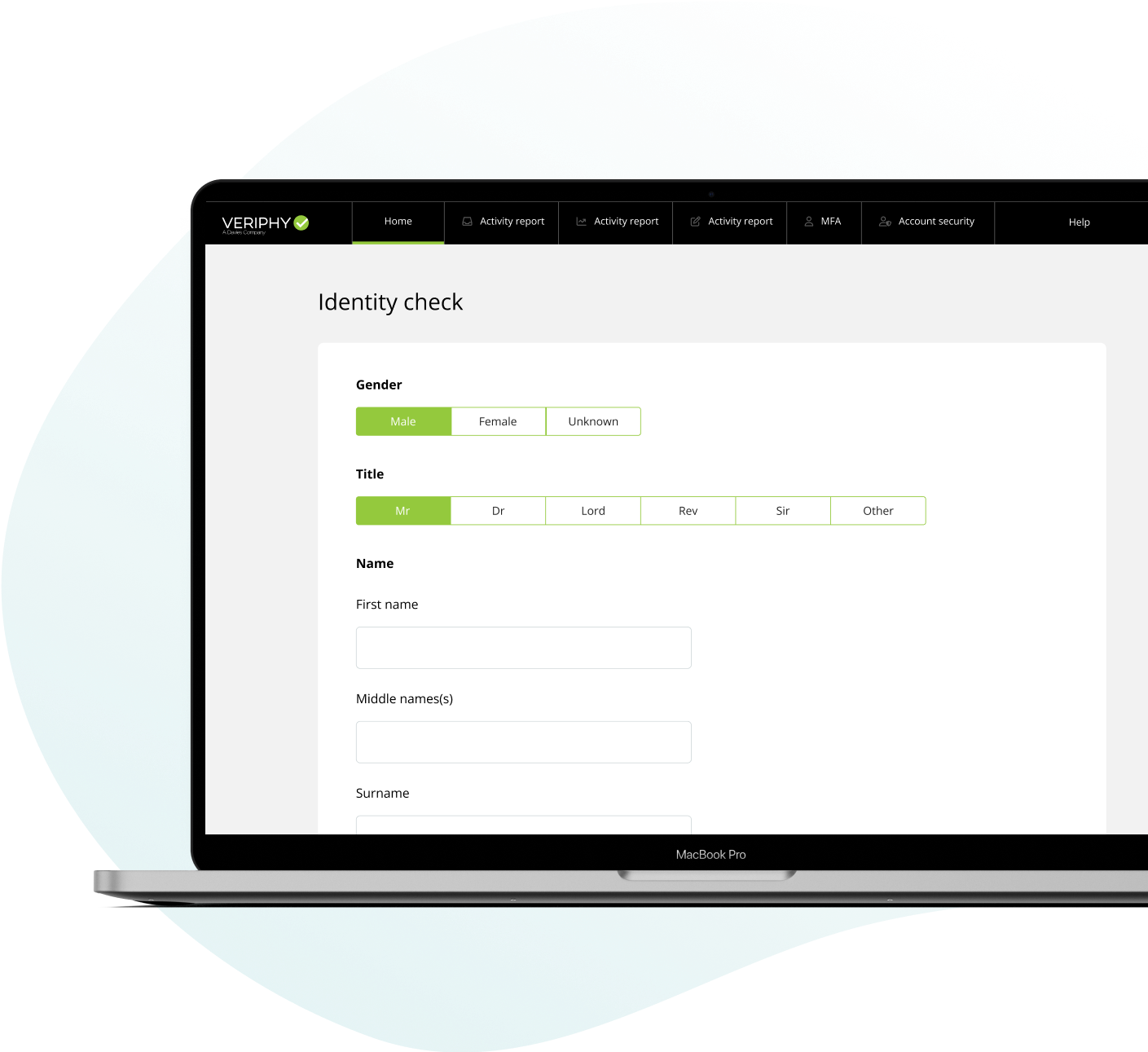

Our AML checks can be used to validate and verify:

- Global ID and ID documents

- UK addresses

- Bank accounts

- Biometric liveness

Our PEP and sanctions monitoring checks will ensure client status changes are immediately communicated to you. This prevents risk, exclusively keeps you doing business with legitimate companies and ensures you’re handling high-risk clients in line with legislation and guidance .

We also offer company reports checks which enable you to get a full overview of UK and international businesses you are considering taking on as a client.

The benefits of our compliance solutions

Our compliance solutions offer many advantages to high-value dealers, including:

- Orchestrating and optimising compliance and onboarding processes

- Enhancing the customer experience

- Boosting revenue potential

- Avoiding regulatory penalties

- Minimising risk and exposure to fraud

Need help with your AML policy?

We can help get your AML policy document up to scratch, and help your organisation avoid risk of money laundering.

These documents include:

- A definition of money laundering

- The duties outlined under the Money Laundering Regulations 2017 (amended in 2019)

- Details regarding customer due diligence

- Assessment of risk to your organisation

- The names of relevant individuals and their AML responsibilities—including a Nominated Officer

- Details of how you’ll monitor and control risk

- Details of how you will keep records

- A commitment to training employees so they’re aware of their responsibilities

- Any disclosures of suspicious activity

- Suspicious activity internal report form

- A list of documents which will be accepted for client identification