Compliance technology for insurance

Safeguard your business from the risks of insurance fraud

Working in a highly regulated market, insurers are always taking steps to protect themselves from exploitation, and financial crime. However, with technology evolving rapidly and fraudsters becoming more and more discreet, even insurance professionals can fall victim to fraudulent claims.

We help to build an extra layer of protection between you and these criminals, with our robust risk-based processes that verify and validate client identity efficiently and effectively.

The number of fraudulent claims detected in 2021 was 89,000, with a total value of £1.1bn

Our InsurTech will help you to avoid AML and CFT risks, giving you the tools you need to protect your business against financial crime and fraudulent claims, and improve the client onboarding experience.

We also have PEP and Sanctions capabilities that continue to monitor your clients over time, for any suspicious activity.

With our suite of compliance solutions, insurers can:

- Stop fraudulent claims and financial crime risks in their tracks

- Efficiently and effectively verify client identity

- Maintain compliance and monitor it continuously

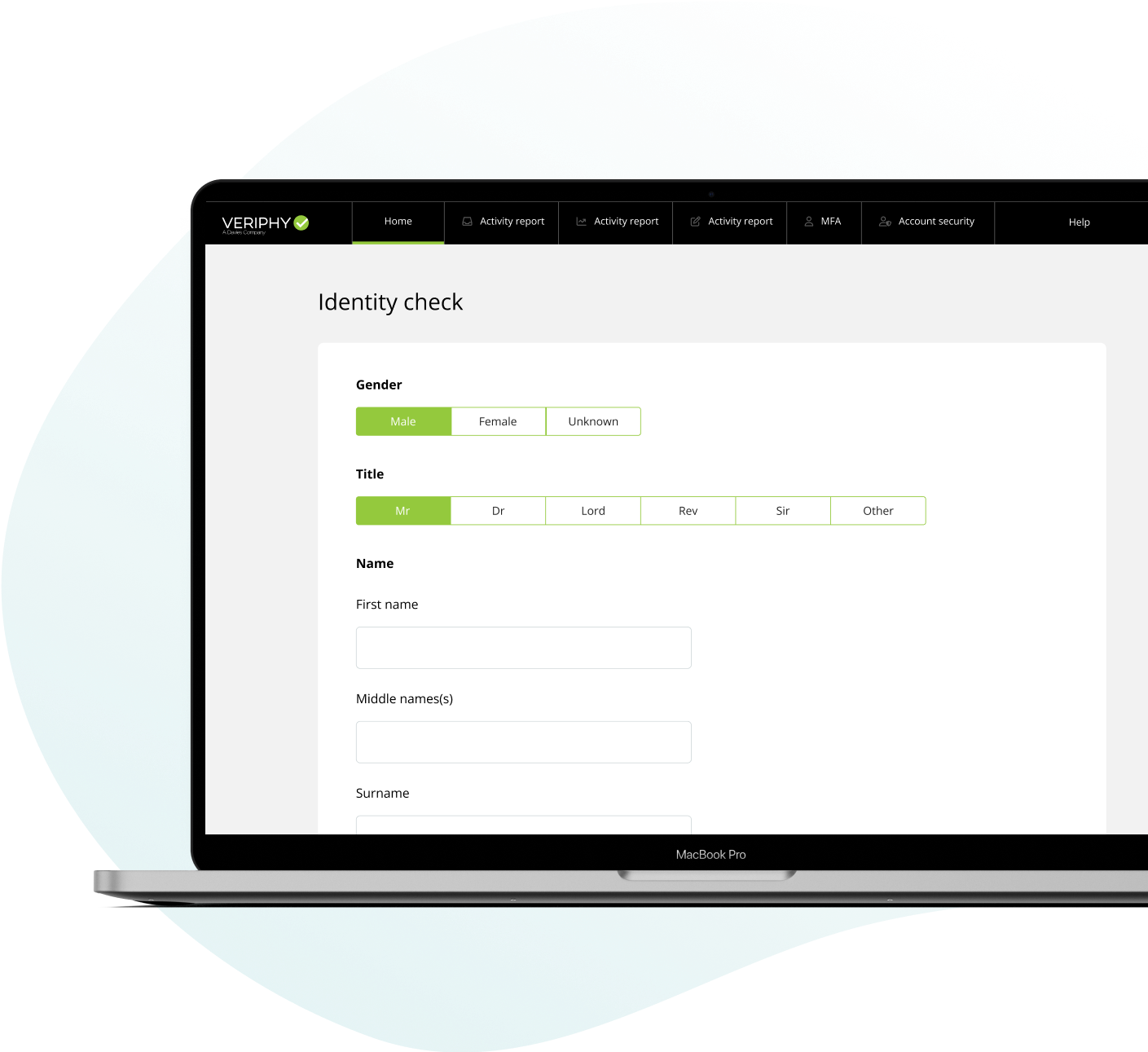

KYC checks for insurers

Within our solutions suite, we also offer KYC checks, so you can validate the legitimacy of your clients and boost the onboarding experience.

With onboarding setting the precedent for how the rest of the customer journey will go, it’s crucial that you make it as seamless and as efficient a process as possible, while remaining compliant.

Our KYC technology can help you to achieve this, with instant ID checks to ensure reliable and robust client due diligence.

Implement our versatile and adaptable API

Protect yourself from insurance-focused financial crime and its associated penalties, with our flexible API. Our API can be seamlessly integrated with your current set-up and provide you with the tools needed to make the best business decisions for each of your clients.

With our compliance technology suites, you can enhance the client onboarding process and unlock additional revenue potential.