Compliance technology for financial services

The financial services sector is one of the most highly regulated markets out there. And with scammers and fraudsters becoming more advanced with their tactics, the FCA are continuously updating their regulations to protect financial services businesses and customers from the risk and impact of financial crime.

Economic crime costs the UK billions per year

Our compliance solutions can help your business to:

- Adhere to AML compliance regulations

- Reduce time needed to onboard clients

- Ensure robust due diligence

Maintain compliance with our AML solutions suite

With lucrative gains, the financial sector is a prime target for fraudsters and money launderers. But often, screening clients for AML purposes is tedious, which can put off clients from moving forward with your business.

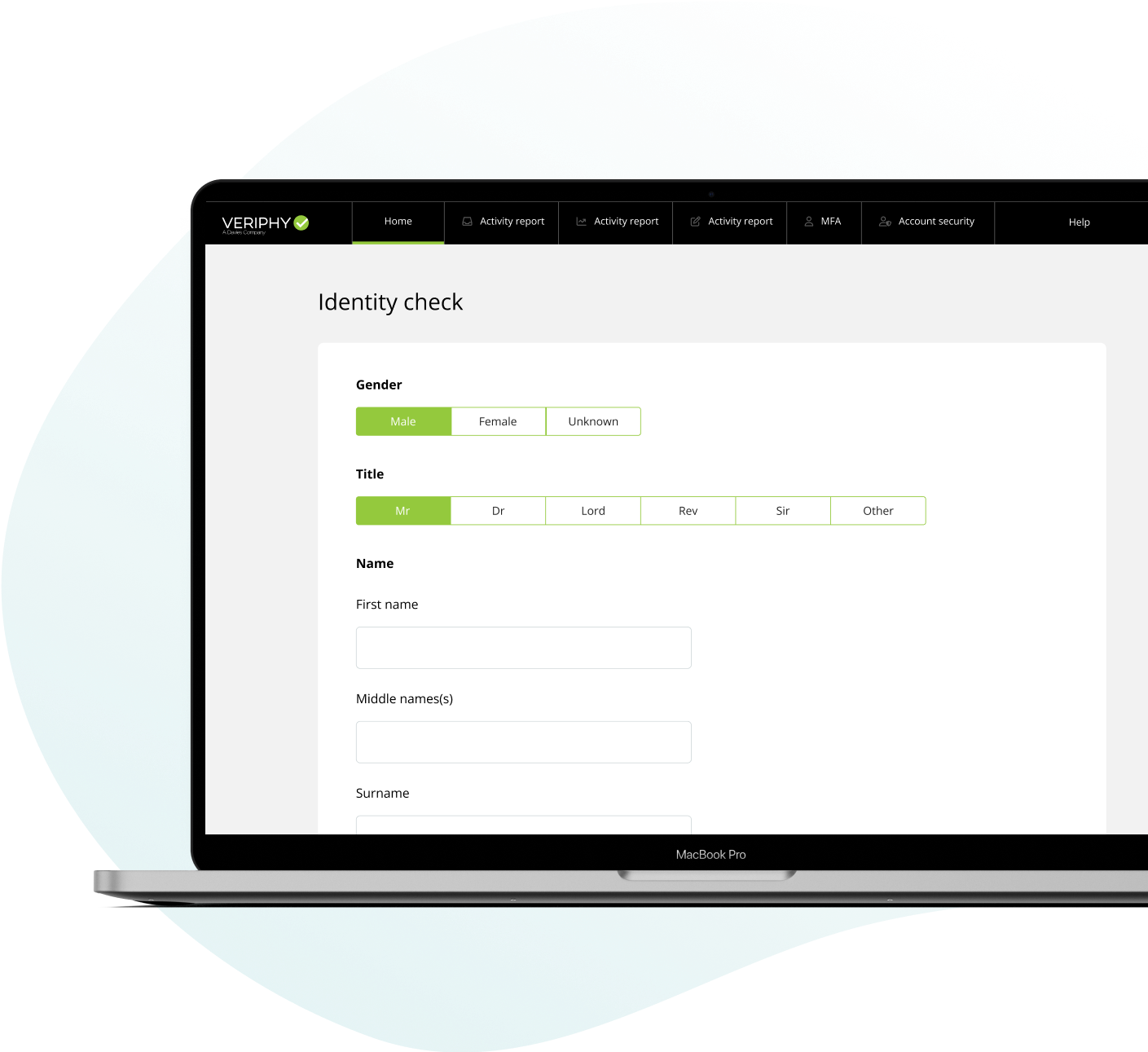

We aim to modernise this with our AML compliance solutions, which can verify and validate client identity and information against robust databases to ensure client due diligence.

Our AML compliance suite goes beyond the basics and can get you the confirmation you need within a matter of seconds, so you can get down to business quicker.

Explore more about our regulatory compliance suite

Streamline client onboarding with our KYC solutions suite

Client onboarding can be the make-or-break for whether a potential client will progress forward with your business for their financial service needs. So ensuring you create a process that is as efficient as possible while remaining compliant is key.

You can integrate our KYC solutions with your existing management systems, and use these to quickly verify and validate client information to get them onboarded in no time.

Explore more about our client onboarding solutions

Trust our flexible API to protect your business

Screening the clients your business offers its financial services to is crucial in avoiding both financial and reputational damage.

Our flexible and adaptable API can help you to remain compliant while smoothing out the onboarding process for your clients. Plus, it can be seamlessly integrated with your existing management systems.

Let us help you to find the best solutions for your clients.