Customer due diligence in AML compliance: What it means and best practices

Anti-money laundering is one of the biggest threats to the financial services and regulated sectors, with the National Crime Agency …

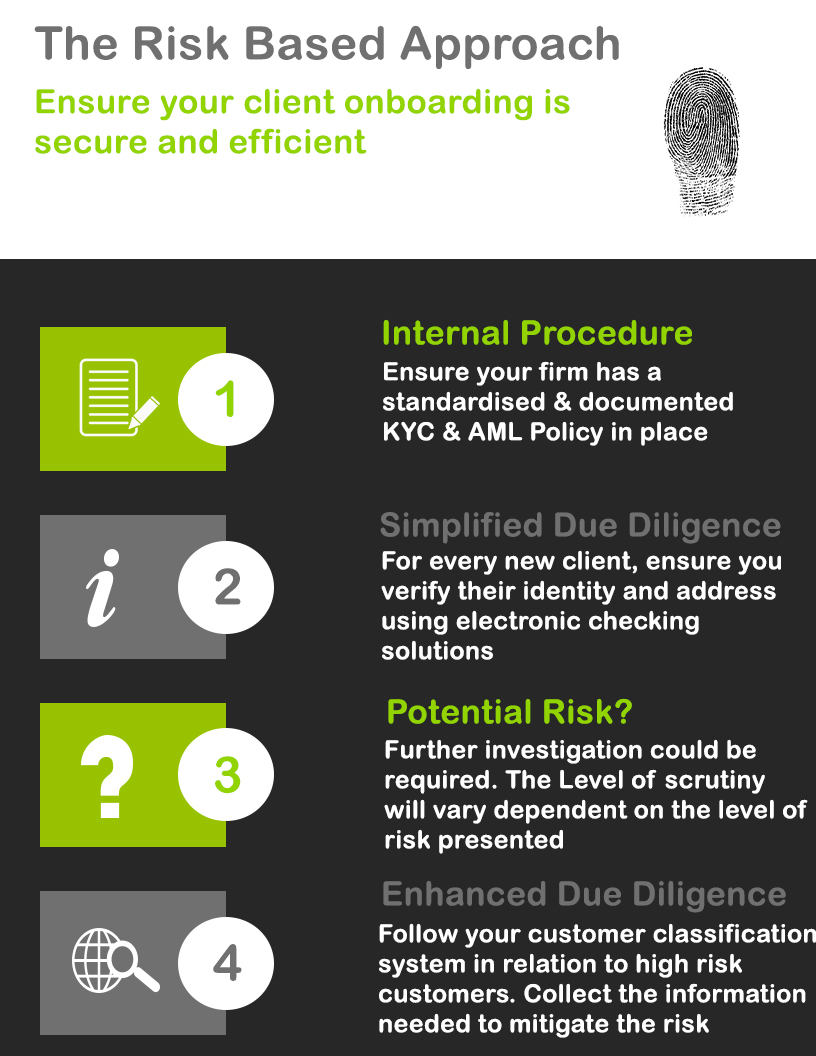

To meet your KYC and AML obligations, you need to carry out identity checks on your clients. These processes can become tiresome as you may have to ask your clients for a great deal of personal information, something they might find intrusive and bothersome if carried out ineffectively.

It doesn’t have to be that way – here are three tips to remain fully compliant whilst delivering a smooth and client-friendly onboarding experience.

Under the new money laundering regulations, it is suggested that electronic verification methods are superior to traditional forms of identity authentication as the directive states they should be used “wherever possible.”

The advantage of electronic verification is that the information is screened against various online and officially recognised sources. This eliminates the potential of human oversight in the detection of fraudulent documents.

Moreover, electronic identification is not only more secure but also a great deal faster than manual screening. Currently Veriphy’s AML checks take just under 3 seconds to process. This fast turnover time facilitates smoother onboarding in a compliant fashion whilst satisfying the expectations of the customer for a fast yet secure experience.

Ensure your organisation has in place robust AML policies and procedures that are standardised and follow a clear risk-based methodology. This ensures that each client is treated fairly and appropriately to the risk that they propose. It also ensures that extra personal information is only gathered and processed when necessary.

With standardised policies and measures to follow, client onboarding will inevitably become more organised, secure and efficient.

Dave wants to buy a property from Ruby’s Estate Agents.

Under their AML policy and procedures they carry out an AML check to verify Dave. They verify his identity and address, but Dave is flagged as a PEP.

According to their policy and current AML legislation, they then have to obtain further information (i.e.) carry out EDD.

The first step would be to ascertain the accuracy of the match, as it may be triggered by a match on name alone.

After confirmation of a positive match, Ruby’s Estate Agents proceed to take adequate measures to establish the source of wealth and source of funds. They investigate the risk of the PEP by checking if the funding is substantial or from an unusual source or if the jurisdiction which appointed the PEP is of a higher risk.

Questions like this are investigated until Ruby’s Estate Agents are comfortable that they do not suspect money laundering. If money laundering is suspected they submit a SARs and report to their MLRO.

Awareness and scrutiny surrounding data security and privacy has increased exponentially, especially since the introduction of GDPR (and equivalent).

Naturally so, the processing of personal information has become a tricky subject to broach with digitally savvy and data conscious individuals.

This is why it is imperative to be transparent about what information you need and why. Having a clear verification policy that is communicated to the client can transform the client onboarding experience.

To ease fears surrounding the processing and storage of an individual’s personal information for regulatory purposes ensure you explain: