Looking ahead – Future regulatory change and its impact on Veriphy clients

The next three years will bring the most significant overhaul of UK AML regulation in more than a decade, and …

Terrorist financing is the route to which terrorist obtain funds to finance their operations.

According to the FATF, terrorist financing is the

“…financing of terrorist acts, and of terrorists and terrorist organisations.”

To combat this issue, many countries have implemented measures for countering the financing of terrorism (CTF) and these measures are often synonymous with anti- money laundering (AML) laws.

The goal of CTF is to ultimately prevent terrorist acts by disrupting their flow of funds.

Usually Terrorist organisations actively look for weaknesses in the financial system to exploit.

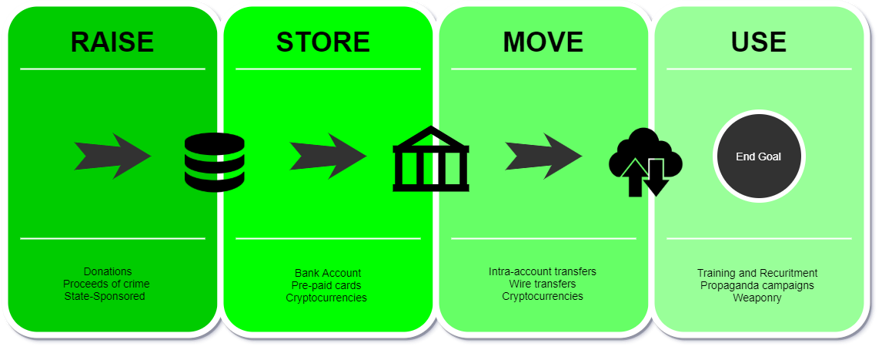

The funding flow usually follows a linear pattern;

Example:

The offences of money laundering and terrorist financing can be committed in connection with each other. For example, where the funds for terrorist activity are ‘laundered’ funds.

However, whilst they may share similar typologies, the difference lies in the timing and direction of the flow of funds and transactions.

Money laundering criminals are concerned with concealing the origin of illicit funds whilst terrorists are more concerned with concealing the nature of their activities.

Money laundering is a cyclical process where the goal is the returning of seemingly legitimate proceeds back to the criminal.

Terrorist financing follows a more linear process with a clear end goal. It is also important to remember that the funds can also be derived from legitimate sources.

Ultimately it is the purposes and ultimate objectives that are different.

The financial sector especially is the target of both processes of financial crime.

They are actively exploited in a criminal manner to facilitate the flow of illicit funds into the economy via concealment and integration techniques and can be used to store and transfer funds for the purposes of terrorist financing.

Financial systems therefore have a choice to either become an unknowing, passive accomplice or an active preventer of criminal activity. This is where effective AML/CTF controls are critical.

Many of the methods used to fund terrorist activity involve the use of the financial system to store and transfer funds. This means financial systems, especially banks, are extremely vulnerable.

In order to protect themselves from exploitation it is imperative to have adequate measures to determine who they are engaging business with.

This means due diligence on new and existing customers is vital for these controls to be effective.

As part of combatting TF, any regulated entity should:

AML/CTF controls should include at a minimum the verification of the identity of the customer or beneficial owner, as well as the collection of knowledge on the customer’s purpose and nature of the business relationship.