Countering Terrorist Financing (CTF) – Fighting Terrorism through AML Controls

February 26, 2020

Beware of Coronavirus-related Fraud & Money Laundering Schemes

April 22, 2020Streamline the Onboarding Journey

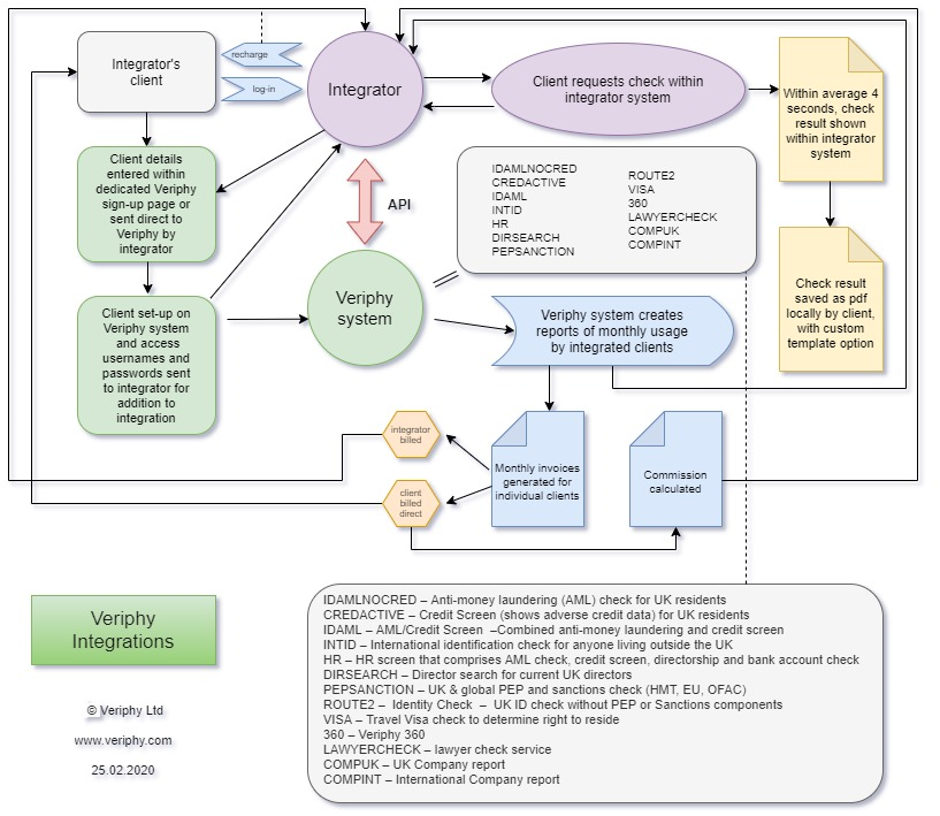

Our Flexible API

As Anti-Money Laundering and KYC obligations increase, businesses must have in place fully secure and adaptive systems to cope with the ever-evolving regulatory compliance landscape.

Compliance is often thought of as a hindrance to business operations. When client identification processes are lack-luster & rigid they can become a procedural nightmare – a mundane, long-winded and frustrating chore.

It doesn’t have to be this way. Full compliance and operational efficiency can be achieved by leveraging existing technology.

Veriphy’s flexible API solution allows clients to securely access and harness data from various data partners from one platform.

The result? Customers can be screened against various industry-approved databases in a matter of seconds enabling businesses to make informed risk management decisions. The customer take-on process becomes faster as internal processes are optimized – satisfying the digitally savvy consumer and improving the overall customer experience.

The Benefits of Integration

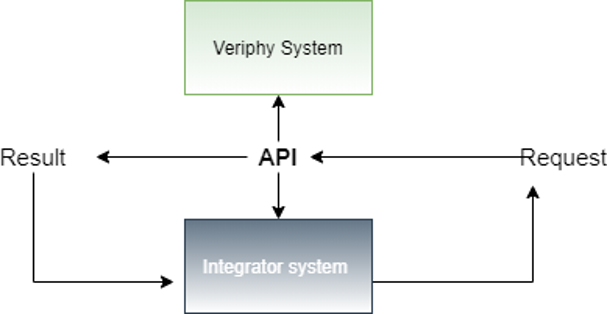

What is an API and what can it do for my business?

An Application Programming Interface (API) essentially allows the sharing of data between two applications. It facilitates the ‘sharing’ relationship as it acts as a messenger behind the scenes and relays data back and forth between the two systems.

- Moldable

- Efficiency

- Optimized onboarding

- Ongoing compliance

- Access to best of breed data

Integrate only the services you need for your AML & KYC processes to your own existing software.

Use data already entered within, for example a CMS, to run the your desired checks.

Streamline the client onboarding process via our single API solution. From one place, clients can securely screen clients in a matter of seconds against various data touchpoints.

Veriphy’s API leverages various data streams to allow clients to gain an accurate & quick assessment of customer risk.

Our API web service allows integrators to access an array of various & reputable data services offered by multiple third-party suppliers.

Harness existing AML & KYC software

Example of Possible Route:

- Integrate Veriphy’s API with existing software and workflows

Integrate Veriphy’s API into your already existing case management system.

- Implementation of Veriphy’s straightforward API into your existing CMS

- Client requests check within integrators system

- Within seconds check result shown within integrators system

- Check result saved as a pdf locally by client*

- Veriphy system creates monthly reports of usage by integrator clients

- Integrator or individual client billed

*our flexible integration options also include the option for branded reports.