Looking ahead – Future regulatory change and its impact on Veriphy clients

The next three years will bring the most significant overhaul of UK AML regulation in more than a decade, and …

As Anti-Money Laundering and KYC obligations increase, businesses must have in place fully secure and adaptive systems to cope with the ever-evolving regulatory compliance landscape.

Compliance is often thought of as a hindrance to business operations. When client identification processes are lack-luster & rigid they can become a procedural nightmare – a mundane, long-winded and frustrating chore.

It doesn’t have to be this way. Full compliance and operational efficiency can be achieved by leveraging existing technology.

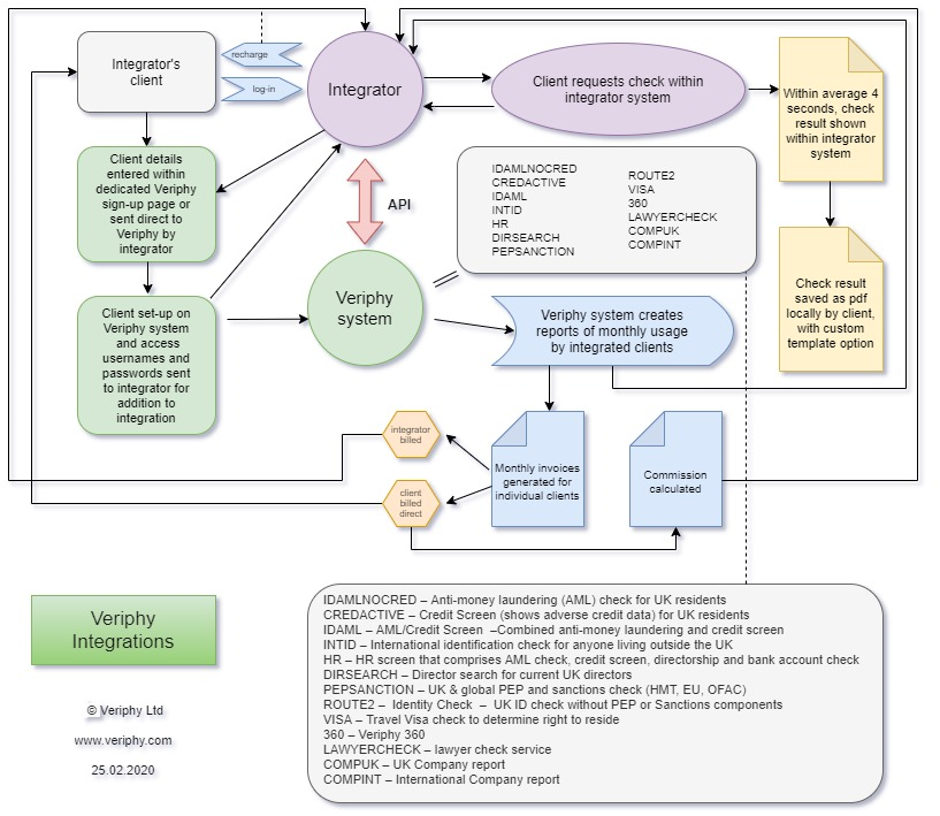

Veriphy’s flexible API solution allows clients to securely access and harness data from various data partners from one platform.

The result? Customers can be screened against various industry-approved databases in a matter of seconds enabling businesses to make informed risk management decisions. The customer take-on process becomes faster as internal processes are optimized – satisfying the digitally savvy consumer and improving the overall customer experience.

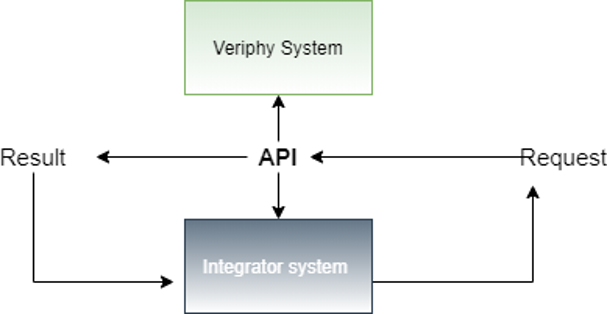

An Application Programming Interface (API) essentially allows the sharing of data between two applications. It facilitates the ‘sharing’ relationship as it acts as a messenger behind the scenes and relays data back and forth between the two systems.

Integrate only the services you need for your AML & KYC processes to your own existing software.

Use data already entered within, for example a CMS, to run the your desired checks.

Streamline the client onboarding process via our single API solution. From one place, clients can securely screen clients in a matter of seconds against various data touchpoints.

Veriphy’s API leverages various data streams to allow clients to gain an accurate & quick assessment of customer risk.

Our API web service allows integrators to access an array of various & reputable data services offered by multiple third-party suppliers.

Integrate Veriphy’s API into your already existing case management system.