Bespoke Anti Money Laundering Policy Document

Carrying out Money Laundering checks is only part of your legal requirement and to stay on the right side of the law, your firm needs to have a Money Laundering Policy in place.

Veriphy can provide you with an effective Money Laundering Policy that is tailor-made for your organisation and specific to your sector.

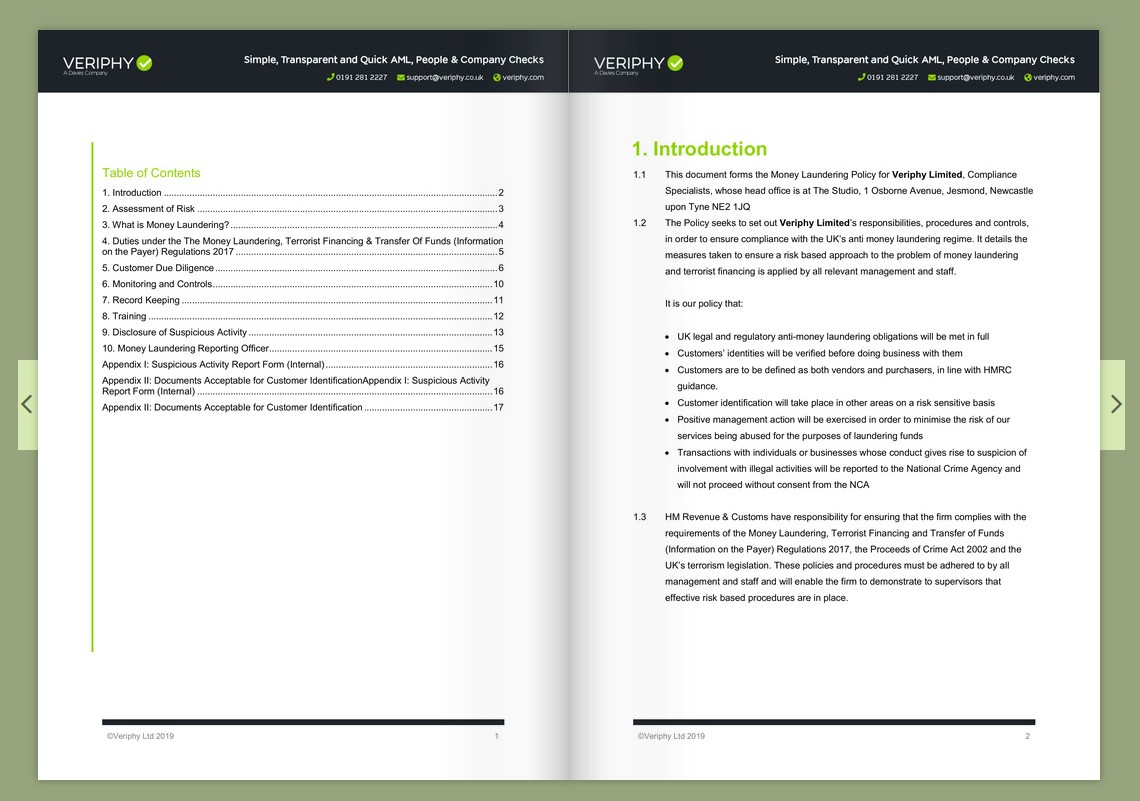

The AML Policy Includes:

- Assessment of Risk

- What is Money Laundering

- Duties under the Money Laundering Regulations 2017 as amended 2019 (implementation of the 5th Money Laundering Directive

- Customer Due Diligence

- Monitoring & Control

- Record Keeping

- Training

- Disclosure of Suspicious Activity

- Nominated Officer

- Suspicious Activity Internal Report Form

- Documents acceptable for Customer Identification

The AML Policy Document

Frequently Asked Questions

1How much is Veriphy's AML Policy Service?

Our bespoke AML policy documents are available from £99+VAT.

Got another question? Please contact us!