AML Checklist – The 6 Key Components to look for in AML Solutions

October 9, 2019

What is Regulatory Compliance?

November 5, 2019“My client has been flagged as a PEP...what does this mean and what am I required to do?”

AML Client Identification Procedures

AML Guidance in relation to Politically Exposed Persons.

What is a Politically Exposed Person (PEP)?

A PEP can be defined as someone who has been entrusted with a prominent public function. There are, however, different ‘tiers’ of PEP which you must be aware of.

Key examples of this include:

- PEP within Governmental Bodies

- E.g. Members of Parliament, Head of State

- PEP within Legislative & Executive Agencies

- E.g. Senior officals of the military, senior diplomats

- PEP within Organisations

- E.g. Board members, senior management of state-owned businesses

- Close associates and family members

- A close associate includes individuals who share beneficial ownership with a PEP or any other close business relationship. The PEPs family unit is also subject to enhanced due diligence.

Why are PEP checks important?

PEPs are considered higher risk clients especially for the financial industry. This is simply because they are more at risk to the exposure of bribery and corruption due to their public position. Due to this vulnerability, it is important to apply enhanced customer due diligence to these individuals because of the greater risk of potential money laundering.

It is important to note, this check is based on a risk-based approach. PEPs should not be discriminated against for their vulnerability to corruption. Your AML check should not fail due to indicating a potential PEP – rather it simply signals the need for enhanced due diligence and monitoring on your part.

What am I required to do?

Key legislation: The Money Laundering, Terrorists Financing and Transfer of Funds (Information on the Payer) Regulations 2017

In accordance with regulation 35, the relevant persons must

"...have in place appropriate risk-management systems and procedures to determine whether a customer or the beneficial owner of a customer is a political exposed person (PEP)"

When a PEP is identified, the relevant person must be able to

"manage the enhanced risks arising from the relevant person's business relationship or transactions with a customer."

Politically Exposed Persons UK PEP Register List Checks

Veriphy's AML Guidance for a PEP

Step 1: Determine if a customer is a PEP

Businesses are not required to perform extensive investigations to determine if an individual is a PEP. Rather, this can be achieved via a simple AML check which includes a screen against a register of publicly known individuals with public functions, their associates and close family.

It is important to note that, inevitably, many PEP matches are false positives. This is due to the absence of information such as date of birth relating to actual PEPs.

Step 2: Enhanced Due Diligence

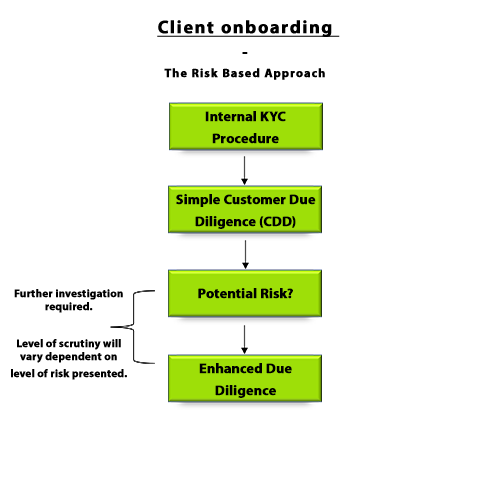

In the event of a client flagging against the PEP list, the relevant person within the organization must revert to their business’s internal KYC and onboarding procedures. Regulated firms should have individual policies and procedures for clients who during the onboarding process, flag up as high-risk.

Enhanced due diligence simply means the collection of additional data on an individual in order to mitigate risk.

Practical examples include:

- Establishing source of funds and wealth

- Enhanced monitoring of transactions

- Carrying out additional searches on the individual (such as an adverse media check)

- Establishing the intended purpose and nature of the business relationship

Step 3: Periodical Reviews

A potential high-risk client will need to be regularly monitored. Most financial organizations have in place systems which monitor for PEPs. This essentially involves screening the individual against the PEP register.

This may be done as part of your annual client base check.

Veriphy also offers a PEP Alert service available on a weekly or monthly basis to ensure your firm always remains compliant.

Know who you are dealing with to keep your organisation fully compliant via Veriphy's PEP alert service.

Limitless Flexibility without a Contract